Welcome to our exploration of Enterprise AI and its potential to revolutionize back-office operations. In this article, we’ll dive into how AI is transforming finance functions, automating complex processes, and unlocking new efficiencies. Get ready for an insightful and playful journey into the future of business operations!

Exploring the Transformative Power of AI in Business Process Enhancement

Imagine stepping into a futuristic office setting in the year 2045, where the hum of activity is not merely from human interaction, but from the synchronized rhythm of robotic assistants and AI algorithms working in tandem with their human counterparts.

In this seamlessly integrated back-office environment, data flows like a swift river between departments, carried on the currents of advanced AI algorithms that have long replaced the siloed databases of old. Robotic assistants glide smoothly along pre-programmed paths, delivering parcels, serving refreshments, and even adjusting the ambient environment to optimize human comfort and productivity. Meanwhile, AI algorithms manage complex tasks such as predictive analytics, real-time data processing, and interdepartmental communications, ensuring that information is always at the fingertips of those who need it, when they need it.

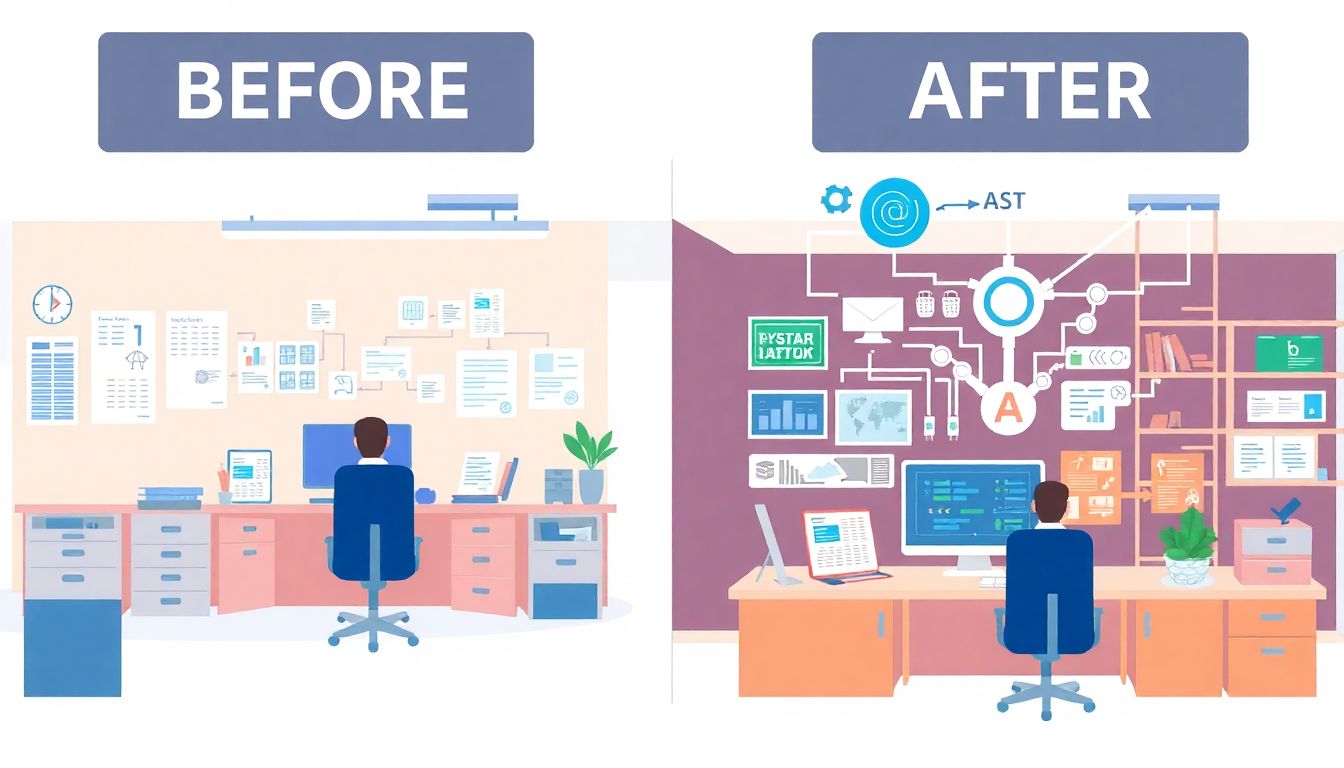

The Back Office: Ready for Its Glow-Up

The current state of back-office operations, particularly within finance teams, is ripe for disruption. Challenges include manual data entry, fragmented systems, and a lack of real-time visibility, all of which lead to inefficiencies, errors, and delayed decision-making. Finance teams are often burdened with repetitive tasks, such as invoice processing, expense management, and financial reporting, which can be time-consuming and prone to human error. The urgent need for digital transformation is evident, as traditional methods struggle to keep pace with the increasing complexity and volume of financial data.

AI offers a promising solution to these challenges, enabling finance teams to streamline operations, reduce errors, and gain valuable insights. By automating routine tasks, AI can free up human resources for more strategic and analytical work. Specifically, AI can address back-office issues through several applications:

-

Robotic Process Automation (RPA):

RPA bots can mimic human actions to perform rule-based tasks, such as data entry, reconciliation, and report generation. This reduces manual effort and minimizes errors.

-

Natural Language Processing (NLP):

NLP can be used to extract and interpret unstructured data from documents like invoices, emails, and contracts, enhancing data processing efficiency.

-

Machine Learning (ML):

ML algorithms can analyze vast amounts of financial data to identify trends, detect anomalies, and predict future outcomes, aiding in better decision-making and risk management.

AI in Action: Streamlining AP and AR

AI-powered solutions are increasingly transforming accounts payable (AP) and accounts receivable (AR) processes, driving efficiency and accuracy to new heights. One of the most significant advances is in invoice processing. Traditionally, invoice processing has been a manual, time-consuming task prone to human error. However, AI algorithms can automate data extraction, validation, and entry, reducing processing time by up to 80% and minimizing errors. For instance, companies like Basware and AvidXchange use AI to convert invoices into digital formats, validating them against purchase orders and receipts, and even coding them automatically for general ledger entries.

However, the benefits of AI in AP and AR extend beyond mere automation. Fraud detection is another area where AI shines. Machine learning models can analyze vast amounts of data to identify anomalies and outliers that may indicate fraudulent activity. According to a report by ACFE, organizations lose an estimated 5% of their revenues to fraud each year. AI can help mitigate these losses by continuously learning and adapting to new fraud patterns. For example, SAP Concur uses AI to detect expense fraud, flagging unusual spending patterns or amounts. Nevertheless, it’s crucial to note that AI models are only as good as the data they’re trained on. Poor data quality or biased data can lead to inaccurate fraud detection, highlighting a significant negative aspect of AI in this context.

Moreover, AI is revolutionizing cash flow forecasting, a critical aspect of AR. Accurate cash flow forecasting is vital for maintaining liquidity and financial stability. AI can analyze historical data, market trends, and other variables to predict future cash inflows and outflows more accurately. A study by Aberdeen Group found that companies using AI for cash flow forecasting saw a 25% improvement in forecast accuracy. For instance, HighRadius employs AI to provide real-time insights into cash flow, helping businesses make data-driven decisions. But again, there’s a flip side. Over-reliance on AI for critical financial tasks can pose risks, especially if the AI system fails or is compromised. Therefore, it’s essential to maintain human oversight and intervention capabilities.

Overcoming Challenges in AI Adoption

The adoption of AI in the back office faces several challenges, notably cultural inertia. Many organizations are entrenched in traditional methods and resist change due to familiarity and comfort with existing processes. This inertia can manifest as skepticism towards AI’s capabilities or fear of job displacement. To overcome this, a clear communication strategy is paramount. Educating stakeholders about the benefits of AI, such as increased efficiency and accuracy, can help alleviate concerns. Additionally, involving employees in the transition process and providing training opportunities can foster a culture more receptive to AI integration.

Another significant barrier is the perceived complexity of AI implementation. Non-technical stakeholders may view AI as an intricate and daunting technology, leading to resistance. To address this, it’s crucial to demystify AI by breaking down its components into understandable concepts. Workshops and seminars led by AI experts can help stakeholders grasp the technology’s fundamentals. Furthermore, starting with smaller, manageable AI projects can build confidence and demonstrate success, paving the way for broader adoption. For instance, implementing AI for a specific task, like invoice processing, can showcase its practical benefits without overwhelming the team.

Moreover, demonstrating ROI is vital to encourage investment in AI technologies. Stakeholders need to see tangible benefits to justify the costs and efforts involved. Here are some strategies to achieve this:

- Conduct pilot projects: Before full-scale implementation, run pilot projects to gather data and quantify potential savings and improvements.

- Benchmark against industry standards: Compare current performance with industry benchmarks to highlight areas where AI can drive significant gains.

- Share success stories: Highlight case studies or success stories from similar organizations that have benefited from AI adoption.

By taking these steps, organizations can make a compelling case for AI investment, turning resistance into advocacy.

FAQ

What are the key benefits of using AI in back-office operations?

- Automation of repetitive tasks, reducing manual effort and errors.

- Enhanced accuracy and real-time insights for better decision-making.

- Improved fraud detection and compliance monitoring.

- Streamlined workflows and increased efficiency.

How can AI transform traditional AP and AR processes?

- Automating invoice processing and flagging discrepancies.

- Predicting payment behaviors and improving cash flow forecasting.

- Enhancing fraud detection through real-time anomaly detection.

- Providing predictive insights for proactive financial strategy.

What are the main challenges in adopting AI for back-office functions?

- Cultural inertia and resistance to change.

- Perceived complexity and technical challenges.

- Demonstrating a clear return on investment (ROI).

- Ensuring data security and compliance.

How can CFOs and finance teams leverage generative AI?

- Creating data visualizations and reports to improve the clarity and accessibility of complex financial data.

- Using AI for strategic and financial tasks, such as forecasting and scenario analysis.

- Incorporating data into the money flow to provide significant improvements for businesses.

- Adopting AI early to gain a competitive advantage.