Welcome to our captivating journey into the future of investing! Today, we’re diving into the exhilarating world of artificial intelligence (AI) and its potential to fuel the Nasdaq’s ascent in 2025. Buckle up as we explore the top 10 AI growth stocks that could skyrocket your portfolio. Let’s make this adventure both informative and enjoyable!

My Top 10 Artificial Intelligence (AI) Growth Stocks to Buy Before It Does

Imagine a sprawling cityscape in the not-so-distant future, where the Nasdaq logo towers over the metropolis, its green hue reflecting off the glass façades of skyscrapers that kiss the sky. This is not your ordinary city; it’s a bustling ecosystem of artificial intelligence, a symphony of technology and innovation. Self-driving cars, sleek and pod-like, glide along the streets with a silent efficiency, their digital sensors communicating seamlessly with the city’s vast digital network, known as the ‘CityWeb.’ Above, drones crisscross the sky, their soft hum a lullaby to the city’s technological heartbeat. They deliver packages, monitor traffic, and even assist in emergency services, all with an AI-powered precision that is as astonishing as it is reassuring.

The sidewalks are a dance of people and robots, each moving with a choreographed grace made possible by the CityWeb’s invisible hand. Robots of all shapes and sizes, from tiny delivery bots to towering construction automatons, interact with the city and its inhabitants, each performing its function with an unyielding dedication. The air is filled with the electric buzz of data, as millions of digital devices communicate with each other and the CityWeb, creating an interconnected web of information that is as vast as it is invisible. The Nasdaq logo, a beacon of this technological revolution, watches over the city, a testament to the power of innovation and the promise of the future.

The AI Revolution: A Catalyst for Market Growth

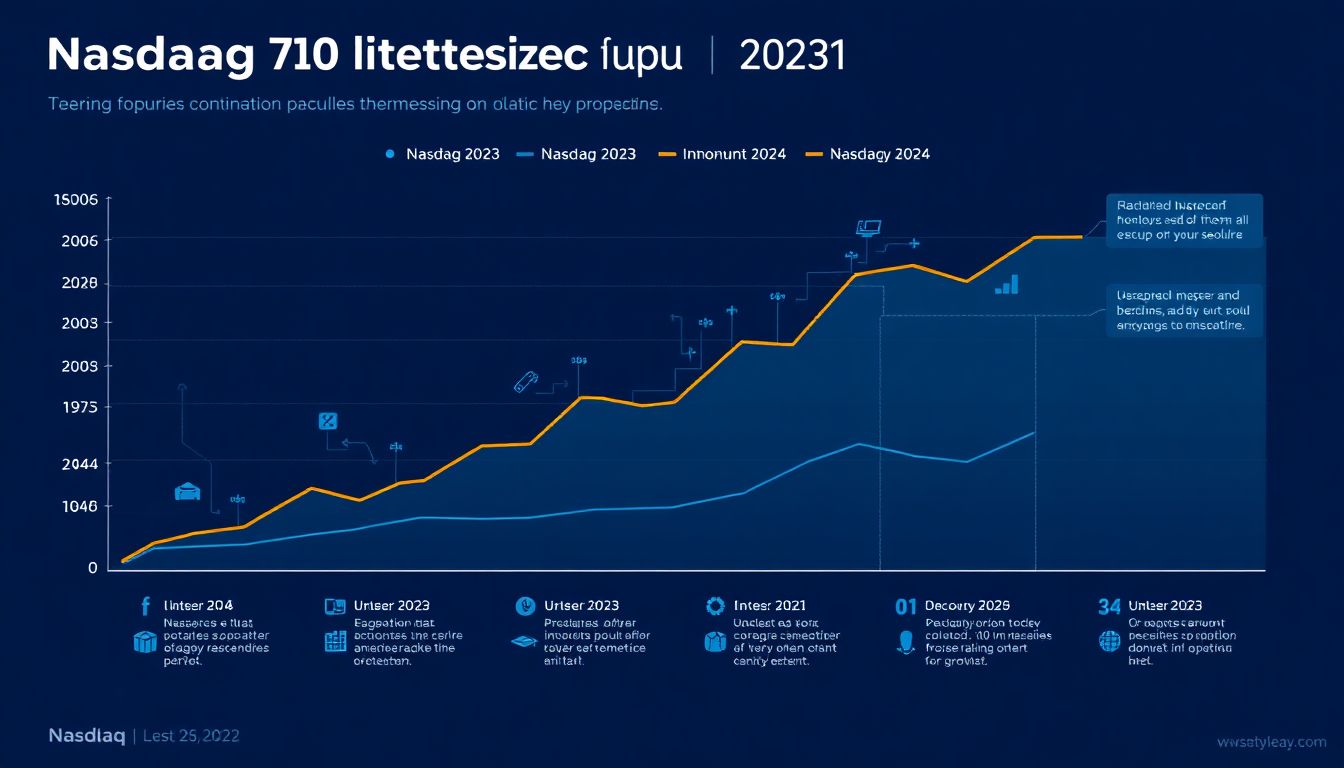

The impact of Artificial Intelligence (AI) on the market recovery has been profound, with the Nasdaq Composite Index serving as a prominent indicator, given its high concentration of tech companies. In 2023, the index saw significant gains, driven by several factors, including the accelerated adoption of AI across industries. AI’s potential to enhance efficiency, innovate products, and create new markets has led investors to bet big on tech stocks. Companies at the forefront of AI development, such as Nvidia, Microsoft, and Alphabet, have seen their share prices soar, bolstering the Nasdaq’s performance. Moreover, the U.S. Presidential election played a pivotal role in shaping market sentiment. The election results provided clarity on political leadership and policy direction, which helped to mitigate uncertainty and fostered a more stable investment environment.

In addition to AI and political developments, interest rate cuts by the Federal Reserve contributed to the Nasdaq’s gains in 2023 and into 2024. Lower interest rates made borrowing cheaper, encouraging businesses to invest in growth opportunities and consumers to spend more freely. This economic stimulus, coupled with the promise of AI-driven innovation, created a favorable backdrop for the tech-heavy index. However, it’s essential to acknowledge the potential negatives. Rapid AI advancements raised concerns about job displacement and societal inequality, while interest rate cuts could lead to higher inflation and market bubbles. Despite these risks, the Nasdaq continued its upward trajectory into 2024, supported by robust earnings reports and optimism around AI’s transformative potential.

Historical context provides further evidence that the Nasdaq could continue to climb in 2025. Looking back at previous market cycles, such as the recovery from the 2008 financial crisis, the index has shown resilience and a strong capacity for growth following periods of economic stress. Furthermore, the rapid digital transformation catalyzed by the COVID-19 pandemic in 2020 demonstrated the tech sector’s ability to adapt and thrive under challenging circumstances. Key factors to watch for in 2025 include:

- The pace of AI innovation and its application across various sectors

- The direction of monetary policy, with potential interest rate hikes to manage inflation

- The geopolitical landscape and its influence on market stability

- The evolution of regulatory frameworks governing AI and the tech industry

As these dynamics unfold, investors will be closely monitoring the interplay between AI’s promising prospects and the broader economic context, which will ultimately shape the Nasdaq’s future trajectory.

Top AI Stocks to Watch in 2025

In the ever-evolving landscape of artificial intelligence, investors are constantly seeking the next big opportunity. As we approach the anticipated Nasdaq surge in 2025, several AI stocks have emerged as front-runners, poised to capitalize on the growing demand for innovative technologies. Among the top contenders are companies like Nvidia, a pioneer in GPU-accelerated computing, and Alphabet Inc., the parent company of Google, which has made significant strides in AI through its Google Brain project and DeepMind acquisition.

Additionally, investors should keep an eye on Microsoft, which is integrating AI into its vast suite of products, and IBM, a leader in enterprise AI solutions with its Watson platform. Amazon is also a key player, leveraging AI for its e-commerce platform and cloud services through Amazon Web Services (AWS). Other notable mentions include Meta (formerly Facebook), which is investing heavily in AI for its metaverse ambitions, and Apple, known for its integration of AI in consumer electronics.

Completing the top 10 list are Baidu, often referred to as the ‘Google of China,’ which is making significant advancements in AI-driven search and autonomous vehicles, and Salesforce, which integrates AI into its customer relationship management (CRM) platform. Lastly, Upstart, a company revolutionizing lending through AI, and Tesla, renowned for its AI-powered autonomous driving technology, round out the list. Each of these companies brings a unique contribution to the AI landscape, making them exciting prospects for detailed discussion.

Nvidia and Palantir: Pioneers in AI Innovation

Nvidia, a titan in the realm of artificial intelligence, has carved out an unassailable niche for itself with its revolutionary GPU technologies. The company’s dominance in AI processing is no fluke; it’s the result of strategic innovation and a deep understanding of the market’s needs. Nvidia’s GPUs, with their parallel processing capabilities, are uniquely suited to handle the complex computations required by AI algorithms. The company’s continued investment in research and development has led to the creation of increasingly powerful and efficient GPUs, such as the A100 and the newly announced H100. These innovations have not only propelled Nvidia to the forefront of the AI hardware market but have also democratized AI, making it more accessible and affordable for businesses of all sizes. However, Nvidia’s success has also brought with it a degree of dependency, with many AI developments now reliant on their specific architecture, which could potentially stifle innovation in the long run.

That being said, every coin has a flip side. Nvidia’s dominance has sparked concerns about market monopolization, with some critics arguing that the company’s position could lead to stagnation in the AI hardware sector due to lack of competition. Moreover, the company’s GPUs, while powerful, are also criticized for their high energy consumption, which raises environmental concerns and operational costs. Despite these drawbacks, Nvidia’s impact on the AI field is undeniable, and its continued success will likely shape the direction of AI technologies in the coming years.

On the software side, Palantir has made significant strides with its AI Platform (AIP). Palantir’s strength lies in its ability to integrate, manage, and analyze large amounts of data from diverse sources, a capability that has found appeal among government agencies and large corporations alike. One of the standout features of Palantir’s approach is its successful boot camps, which have proven to be an effective strategy for growth and deal conversions. These boot camps serve a dual purpose:

- they help potential clients understand the platform’s capabilities

- they provide Palantir with valuable feedback to refine and improve their offerings.

Furthermore, Palantir’s growth has been nothing short of impressive, with a steadily increasing client base and revenue growth. However, Palantir is not without its controversies. The company’s work with government agencies, particularly in areas like immigration and law enforcement, has raised ethical concerns and sparked public debates. Additionally, some critics argue that Palantir’s technologies could be used to infringe on privacy and civil liberties, underscoring the need for responsible and transparent AI use. Nevertheless, Palantir’s success highlights the growing demand for powerful data analytics tools and the potential of AI in transforming data-driven decision-making.

FAQ

What is the economic impact of generative AI expected to be by 2030?

What are some of the key AI offerings from Microsoft?

How is Broadcom positioned to benefit from the AI revolution?

What steps is TSMC taking to meet the surging demand for AI processors?

- Building three semiconductor fabrication facilities to bring greater economies of scale.

- Beginning volume production in the first facility early next year.

- Collaborating with almost every AI innovator to capitalize on the sizable opportunity.