Welcome to our insightful exploration of the artificial intelligence (AI) landscape! Today, we’re diving into the exciting world of AI stocks, where innovation meets investment. Join us as we uncover three hidden gems in the AI sector that Wall Street analysts believe could skyrocket by 60% to 194% in 2025. Buckle up for an engaging journey through semiconductors, servers, and cutting-edge technology!

Discover the AI stocks that could redefine your investment portfolio in the coming years.

Imagine a banner image that seizes attention with its stark portrayal of a future dominated by AI-driven technologies. The backdrop is a sprawling cityscape at dusk, but the real stars are the intricate renders of advanced semiconductors, their microscopic components brought to life in vivid, neon hues. Beside them, towering data centers stretch towards the sky, their server racks pulsating with data, illustrated as streams of glowing particles, depicting the relentless pace of data processing. The scene is tied together by AI servers, rendered as levitating, holographic interfaces, their complex algorithms visualized as interlocking geometric patterns, constantly evolving and adapting.

The futuristic tableau is not complete without the promise of prosperity. Prominently featured are dynamic stock market graphs, their lines trending upwards in a vibrant green, signifying growth potential. These graphs are not mere afterthoughts, but integrated seamlessly into the scene, projected onto the facades of skyscrapers, or reflected in the mirrored surfaces of the AI servers. They tell a story of investment and return, of potential harnessed and rewards reaped.

To add a final touch of authenticity, the banner includes subtle animations – the cool hum of the data centers, the dance of the algorithms, the real-time fluctuations of the stock market graphs. These elements bring the scene to life, making it more than just a static image, but a window into a dynamic future where AI technologies are the driving force behind economic growth and innovation.

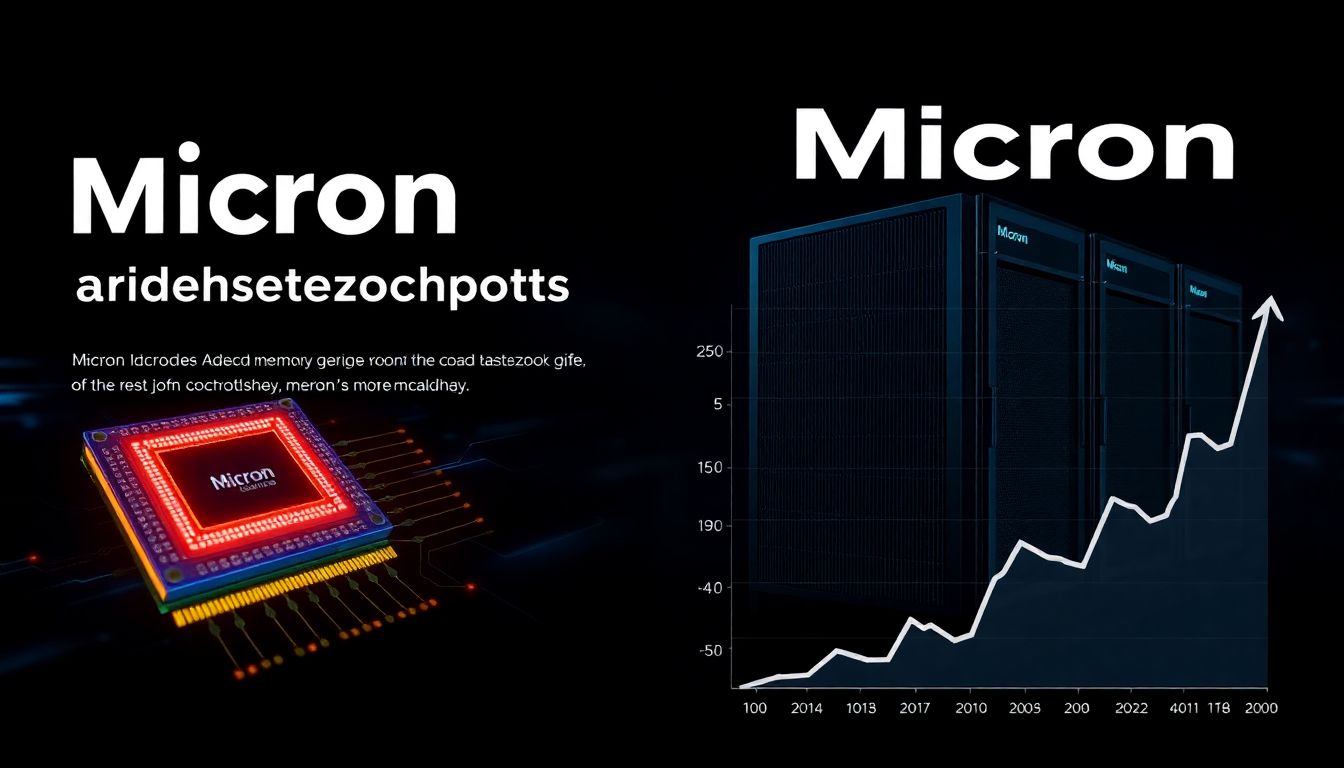

Micron Technology: A Chipmaking Powerhouse

Micron Technology, established in 1978, has carved a niche for itself in the competitive semiconductor industry by specializing in memory chips, particularly DRAM and NAND, which are vital components in AI servers, data centers, and consumer electronics.

The company’s recent performance has been notable, despite the inherent cyclicality of the semiconductor industry. Micron’s revenues have been subject to fluctuations, with periods of oversupply and demand downturns, such as the recent PC market decline, impacting their financials. However, the company has demonstrated resilience, with a fiscal Q2 2023 revenue of $4.61 billion, albeit a 53% year-over-year decrease, and a non-GAAP EPS of $0.24, beating analyst expectations. The company has also shown commitment to innovation, with an R&D spend of $821 million in the same quarter, signaling a proactive approach to staying ahead in the technology race.

Several factors contribute to analysts’ bullish stance on Micron’s future, with a consensus price target suggesting an impressive 194% implied upside:

- The increasing demand for AI and high-performance computing (HPC) is expected to drive growth for DRAM and NAND chips.

- The company’s strategic partnerships, such as with NVIDIA, reinforce its position in the AI and data center markets.

- Micron’s geographically diversified manufacturing footprint, with facilities in the U.S., Asia, and Europe, mitigates risks associated with regional disruptions.

- The company’s strong balance sheet and history of shareholder returns, including a dividend yield of about 2.5%, reflect a commitment to delivering shareholder value.

However, it’s crucial to remember that Micron’s future performance will depend heavily on market demand, successful execution of its strategic initiatives, and its ability to navigate the cyclical nature of its industry.

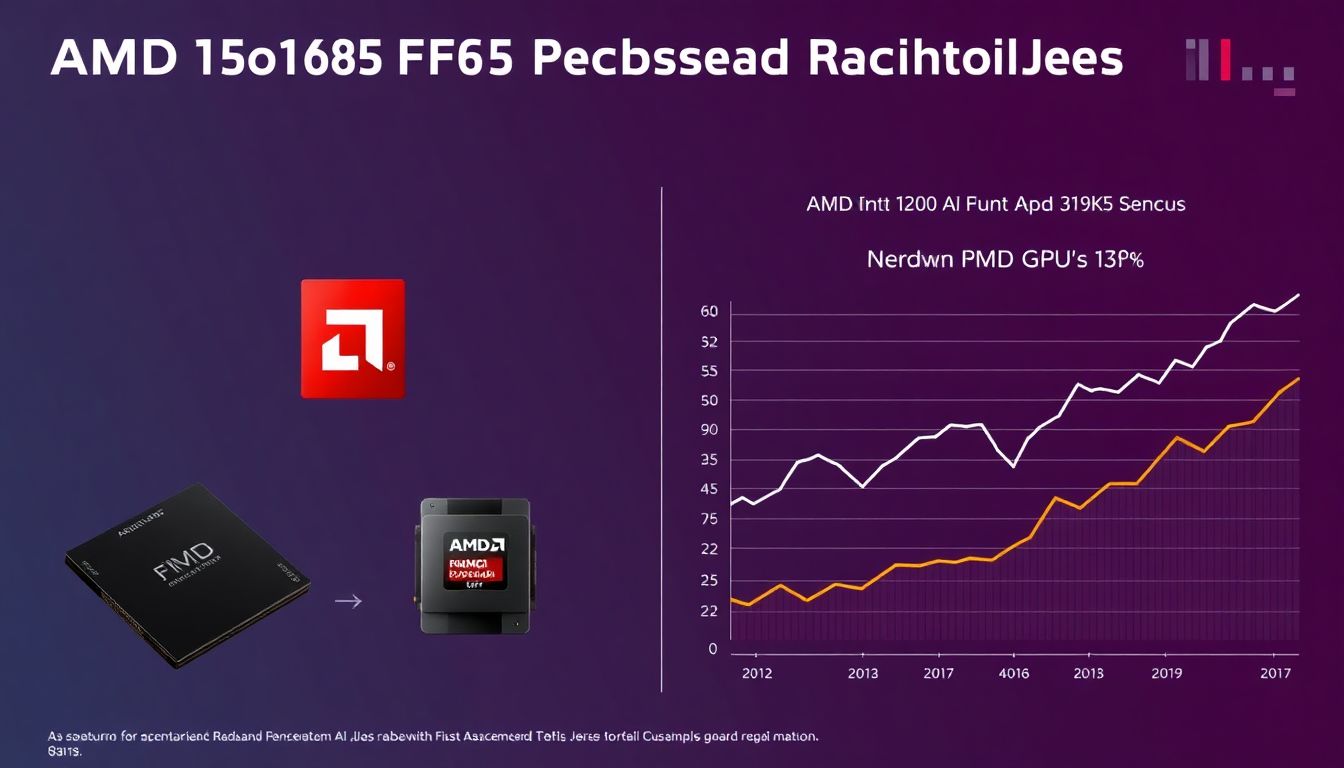

Advanced Micro Devices: A Formidable AI Contender

Advanced Micro Devices (AMD), a prominent semiconductor company, has carved out a significant niche in the tech industry with its production of high-performance GPUs and AI accelerator chips. One of AMD’s primary strengths lies in its innovative approach to chip design, particularly its focus on high-performance computing (HPC) and graphics processing. The company’s Radeon GPUs and RDNA architecture have been well-received for their efficiency and performance, making them a favorite among gamers and professionals alike. Additionally, AMD’s acquisition of Xilinx has bolstered its capabilities in AI and machine learning, providing a robust portfolio of adaptive computing solutions.

AMD’s role in the growing AI market is noteworthy, as it continues to challenge industry giants like Nvidia. AMD’s AI accelerator chips, such as the MI200 series, offer competitive performance and energy efficiency, making them attractive for data centers and AI research facilities. The company’s open-source software initiatives, like the ROCm platform, further enhance its appeal by providing developers with flexible tools for AI and HPC applications. This commitment to open standards and versatility gives AMD a competitive edge, as it allows for broader adoption and integration across various industries.

Analysts’ optimistic outlook on AMD, with a 106% implied upside, can be attributed to several factors:

-

Market Growth:

The AI and HPC markets are expanding rapidly, driven by demand from sectors like autonomous vehicles, cloud computing, and scientific research.

-

Product Portfolio:

AMD’s diverse and competitive product lineup, including its EPYC CPUs, Radeon GPUs, and AI accelerators, positions it well to capitalize on these growth opportunities.

-

Financial Performance:

The company has demonstrated strong financial results, with consistent revenue growth and improving margins.

-

Innovation Pipeline:

AMD’s commitment to research and development ensures a steady stream of innovative products, keeping it competitive against rivals like Nvidia and Intel.

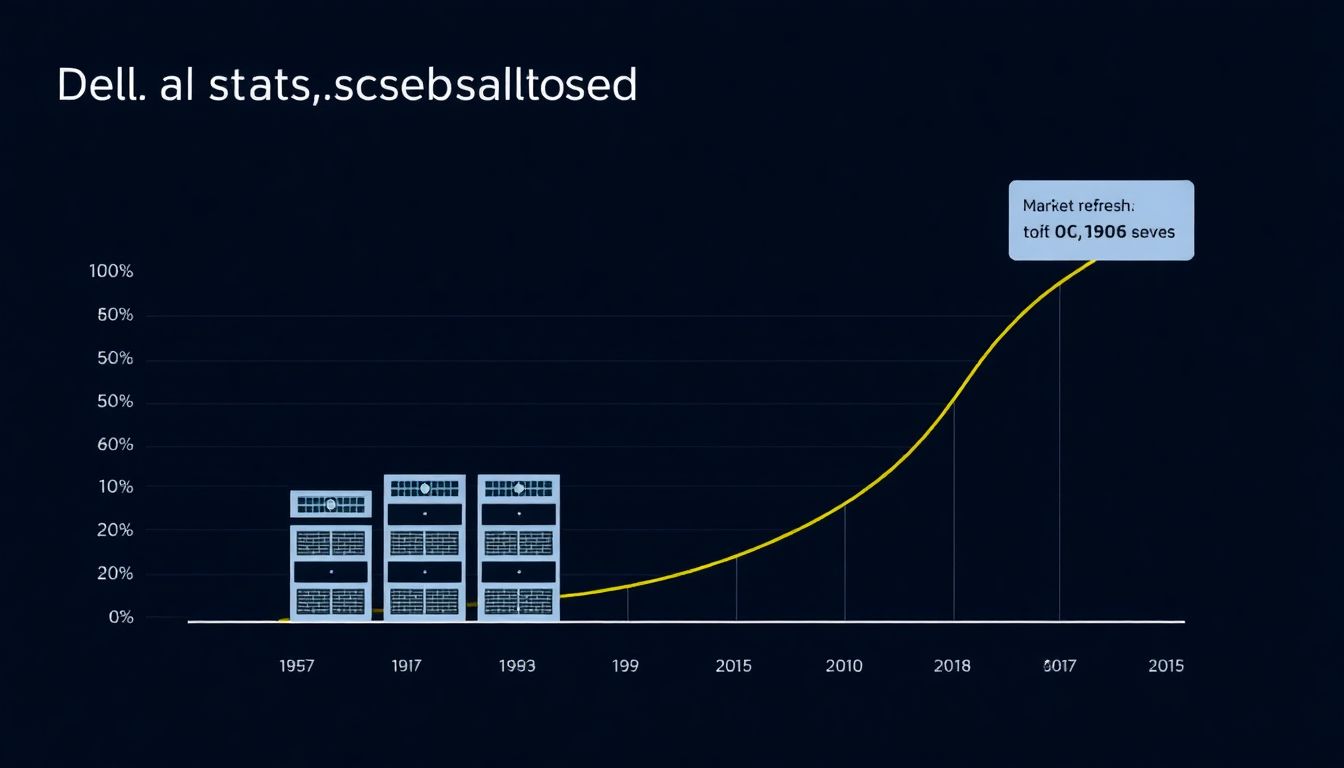

Dell: Servers Paving the Way to AI Success

Dell Technologies, once primarily known for its personal computers, has been aggressively expanding its server business, which has become a significant growth driver for the company. Dell’s server and networking revenue has been steadily rising, with the company now ranking among the world’s largest server vendors. This growth is largely attributable to Dell’s strategic investments in research and development, leading to innovative server solutions that cater to the evolving needs of data centers and enterprises. Central to this success is Dell’s portfolio of AI-optimized servers, designed to handle the intensive computational workloads of artificial intelligence and machine learning applications. These servers, such as the PowerEdge XE8545 and DSS 8440, incorporate cutting-edge technologies like advanced GPUs and optimized software stacks to deliver high performance and efficiency.

However, while Dell’s server business is thriving, its traditional PC business faces substantial challenges. The global PC market has been grappling with declining sales and shrinking profit margins, exacerbated by factors such as increased competition, longer device refresh cycles, and the impact of geopolitical issues on supply chains. Dell has responded by focusing on premium and gaming segments, introducing innovative products like the XPS 13 and Alienware series, and investing in convertible and 2-in-1 devices to cater to evolving consumer preferences. Nevertheless, the PC business remains under significant pressure, which has led Dell to prioritize its enterprise solutions and service offerings.

Despite the challenges in the PC market, analysts remain bullish on Dell’s stock, with some seeing an implied upside of approximately 60%. This optimism is fueled by several factors:

- The robust growth and high margins of Dell’s server and enterprise solutions businesses.

- The company’s strong cash flow generation and commitment to shareholder returns through dividends and share buybacks.

- Dell’s strategic positioning to capitalize on emerging technologies such as AI, machine learning, and edge computing.

- The company’s successful integration of VMware, which has enhanced its software and cloud offerings.

Furthermore, Dell’s efforts to diversify its business, reduce its debt burden, and streamline operations have been well-received by the analyst community, contributing to the positive outlook on its stock.

FAQ

What makes these AI stocks attractive investments?

How does Micron Technology’s cyclicality impact its stock?

What sets Advanced Micro Devices (AMD) apart in the AI market?

How is Dell’s server business driving its growth?

What are the key takeaways for investors considering these AI stocks?

- These AI stocks offer significant upside potential, as indicated by Wall Street analysts.

- Each company plays a crucial role in the growing AI sector, with products and services poised for increased demand.

- Investors should consider the unique challenges and opportunities faced by each company when evaluating these stocks for their portfolio.