Welcome to our playful and insightful guide on investing in AI stocks! As we step into 2025, the U.S. stock market has shown remarkable resilience, with technology companies, particularly those connected to the artificial intelligence (AI) trend, leading the charge. While many AI stocks have soared to great heights, there are still opportunities for savvy investors. Let’s dive into two industry leaders that could be smart picks for January 2025.

Uncovering the best AI investments for the new year

Imagine a sprawling metropolis of tomorrow, where gleaming skyscrapers of glass and steel stretch towards the heavens, their surfaces adorned with colossal digital displays—not with the usual advertisements, but with real-time stock market graphs and financial charts, their peaks and valleys pulsating like the city’s heartbeat. This is not merely a city; it’s a living, breathing financial hub, where the intangible dance of numbers is as much a part of the landscape as the towering buildings themselves.

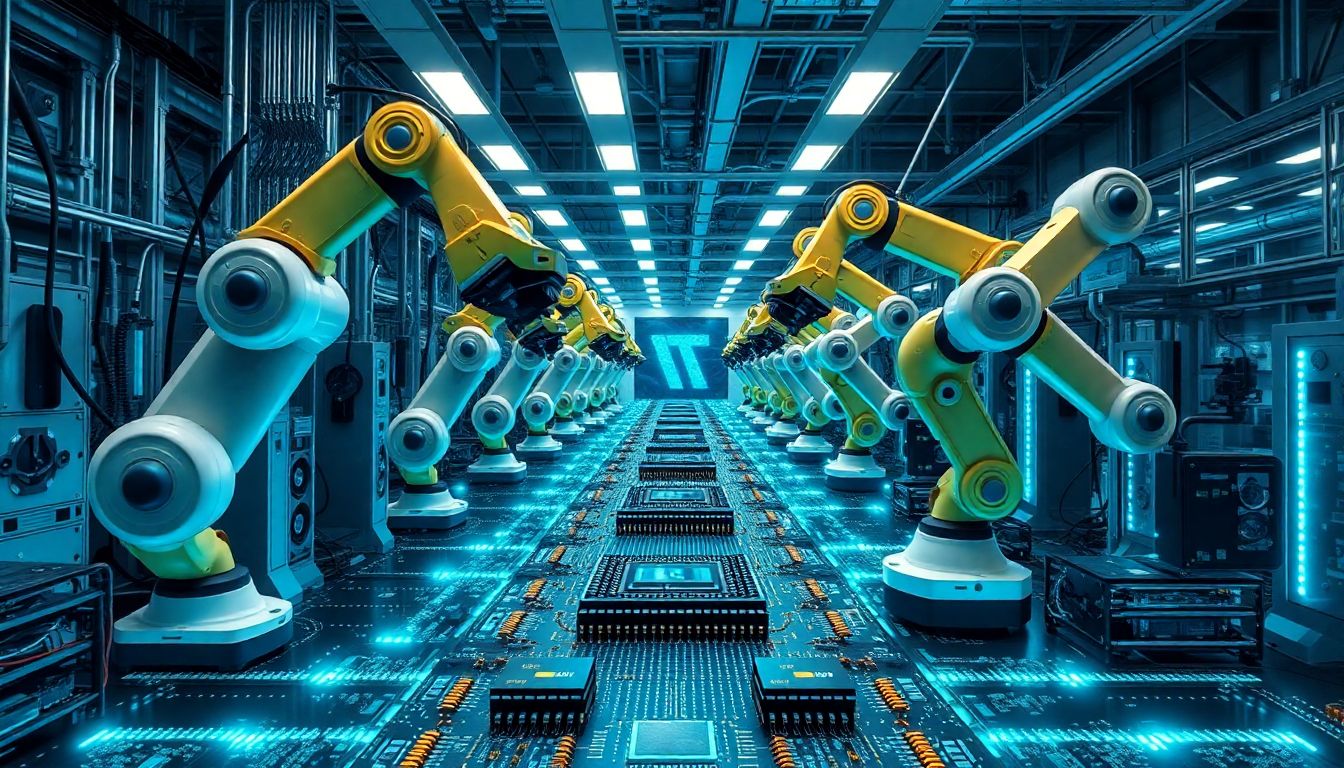

In this futuristic urban jungle, the usual hum of traffic is replaced by the whisper-quiet whirr of drones and the efficient click-clack of robotic feet on pavement. These are not the clunky automatons of yesteryears, but sleek, AI-powered machines that move with a grace belied by their metallic forms. They are the financiers of the future, hurrying between meetings, analyzing market trends in nanoseconds, and making deals at the speed of thought. Behind them, holographic charts float in the air like spectral sentinels, representing the intersection of technology and finance in this brave new world.

Taiwan Semiconductor Manufacturing: The Backbone of AI Innovation

Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as a pivotal player in the AI industry, largely due to its unparalleled prowess in advanced semiconductor manufacturing. TSMC’s role is particularly notable through its strategic partnerships with major AI innovators such as NVIDIA, Google, and Apple. These collaborations have not only accelerated the development of cutting-edge AI technologies but have also solidified TSMC’s position as the go-to foundry for high-performance computing (HPC) and AI-specific chips.

TSMC’s dominance is further underscored by its impressive financial performance and market expectations. The company has seen consistent revenue growth, with a significant portion attributable to the demand for AI and HPC chips. In 2022, TSMC reported a staggering 42.6% increase in revenue year-over-year, driven largely by the demand for its advanced nodes, particularly the 5nm and 7nm processes which are crucial for AI applications. Market analysts expect this trend to continue, with TSMC’s market share in the global foundry market projected to remain above 50% in the coming years.

To maintain its lead, TSMC has ambitious expansion plans for advanced chip production. The company is investing heavily in new fabrication plants (fabs) and R&D to ensure it stays at the forefront of semiconductor technology. Key initiatives include:

- A $12 billion investment in Arizona for a new 5nm fab, marking its first major production facility in the United States.

- Plans to build a $7 billion fab in Japan focusing on advanced nodes.

- Continued R&D to develop 3nm and 2nm technologies, which promise even greater performance and efficiency for AI applications.

While these investments are crucial for meeting the growing demand for AI chips, they also present challenges, such as geopolitical tensions and supply chain complexities. Nevertheless, TSMC’s strategic moves underscore its commitment to driving innovation in the AI industry.

Microsoft: Leading the AI Revolution

Microsoft’s metamorphosis into a leading AI contender has been nothing short of remarkable, driven largely by its strategic investment in OpenAI. The company’s integration of AI technologies into its core offerings has not only revitalized its product suite but has also positioned it as a formidable player in the AI race. Microsoft’s investment in OpenAI, the company behind popular AI models like DALL-E 2 and ChatGPT, has been a masterstroke. This partnership has facilitated the integration of cutting-edge AI capabilities into Microsoft’s ecosystem, notably in products like Azure, GitHub Copilot, and the Microsoft 365 suite. This symbiotic relationship has allowed Microsoft to leverage OpenAI’s advancements, while OpenAI benefits from Microsoft’s vast resources and enterprise reach.

The financial implications of Microsoft’s AI investments are already being reflected in its revenue growth. In recent quarters, the company has reported a surge in its cloud and AI-related services.

- Azure‘s revenue growth has been particularly noteworthy, with AI functionalities driving demand and customer adoption.

- Microsoft’s enterprise AI solutions have also gained significant traction, with businesses increasingly relying on Microsoft’s AI-powered analytics, automation, and predictive capabilities.

However, it’s not all smooth sailing. The considerable costs associated with AI development and implementation, along with the potential for decreased margins due to competitive pricing pressures, pose challenges to Microsoft’s financials.

The potential impact of OpenAI’s recent restructuring on Microsoft’s financials also warrants consideration. OpenAI’s transition into a ‘capped-profit‘ company aims to balance profitability with safety and ethical considerations in AI development. While this could align with Microsoft’s long-term AI vision, it may also limit short-term financial gains. Moreover, the significant capital investment required to keep pace with AI advancements could strain Microsoft’s resources. Nevertheless, Microsoft’s commitment to AI, bolstered by its strong enterprise customer base and robust cloud infrastructure, positions it well to navigate these challenges and capitalize on the immense opportunities in the AI sector.

Why These Stocks Could Be Smart Picks for 2025

TSMC and Microsoft: Powerhouses in Tech with Robust Growth Prospects

Taiwan Semiconductor Manufacturing Company (TSMC) and Microsoft are two titans in the tech industry that offer attractive investment prospects for 2025. TSMC, the world’s largest dedicated independent semiconductor foundry, is poised for significant growth due to several factors. Firstly, the increasing demand for advanced chips in AI, 5G, and IoT applications plays to TSMC’s strengths. Secondly, the company’s dominant market position and cutting-edge technology (TSMC is already working on 2nm process technology) ensure its competitiveness. Financially, TSMC is robust, with a strong balance sheet, high profit margins, and consistent cash flow. The company’s capital expenditure is expected to remain high, reflecting its commitment to maintaining its technological edge.

Microsoft, on the other hand, is a diverse tech giant with a strong foothold in cloud computing, software, and gaming. The company’s Azure cloud platform is a formidable competitor to Amazon Web Services, with a growing market share. The shift towards remote work and digital transformation has further accelerated Microsoft’s growth. Moreover, Microsoft’s financials are impressive, with a massive market capitalization, substantial free cash flow, and a healthy dividend yield. The company’s strategic acquisitions (such as LinkedIn and GitHub) and investments in AI and quantum computing further bolster its long-term prospects.

While both TSMC and Microsoft present compelling investment cases, it’s essential to remember the old adage: ‘Don’t put all your eggs in one basket.’ Even the most promising stocks can have off days, and market volatility is a fact of life. So, consider these stocks as part of a diversified portfolio. And remember, investing is a marathon, not a sprint. Long-term investing strategies, combined with periodic portfolio reviews, can help you navigate market fluctuations and build wealth over time. Plus, wouldn’t it be boring if all your investments were in the same basket? Spice things up with a variety of stocks, bonds, and other assets to keep your portfolio exciting and resilient!

FAQ

What makes TSMC a dominant player in the AI hardware market?

How has Microsoft’s investment in OpenAI benefited the company?

What are some key growth catalysts for Microsoft in 2025?

- Azure cloud computing business

- Enterprise AI solutions

- Gaming business expansion

- Strong financial profile and shareholder rewards