Welcome to our insightful guide on investing in AI ETFs! As we approach 2025, artificial intelligence (AI) continues to dominate the stock market, with standout performances from AI chip stocks, software stocks, and even energy stocks. With major tech companies investing heavily in AI, this technological revolution is set to be a leading story throughout 2025. However, picking individual winners can be challenging. That’s why we’re exploring two top AI ETFs that offer diversified exposure to this exciting field. Let’s dive in!

Navigating the AI Revolution with Smart Investments

The illustration before us is a panorama of the future, a cityscape teeming with AI-driven technologies that are as ubiquitous as they are advanced. Self-driving cars, sleek and futuristic, glide along the streets, their intricate sensors and algorithms allowing them to navigate with precision and ease. They are not merely vehicles, but mobile data centers, constantly learning and adapting, communicating with each other and the city’s infrastructure in a seamless ballet of efficiency. The city’s power supply is managed by a smart grid, an intelligent network that optimizes energy distribution, predicts demand, and minimizes waste, all while integrating renewable energy sources with a deftness that borders on artistry.

At the heart of this futuristic metropolis lie the advanced data centers, towering structures that serve as the city’s brain, processing unfathomable amounts of data in real-time. These are not the data centers of old, but evolved entities, powered by AI and machine learning, capable of predicting trends, identifying patterns, and making decisions that drive the city’s growth and sustainability. They are the invisible hands that guide the city’s self-driving cars, manage its smart grid, and keep its digital infrastructure humming.

Interestingly, the illustration also prominently displays stock market charts and ETF symbols, suggesting a deep integration of AI and finance. In this future, AI is not just a tool for convenience or sustainability, but also a key player in the world of investment and economics. The charts and symbols hint at a market that is driven by AI-powered algorithms, predicting market trends with uncanny accuracy, managing portfolios with surgical precision, and perhaps even blurring the line between human and artificial intelligence in the world of finance.

What to Look for in an AI ETF

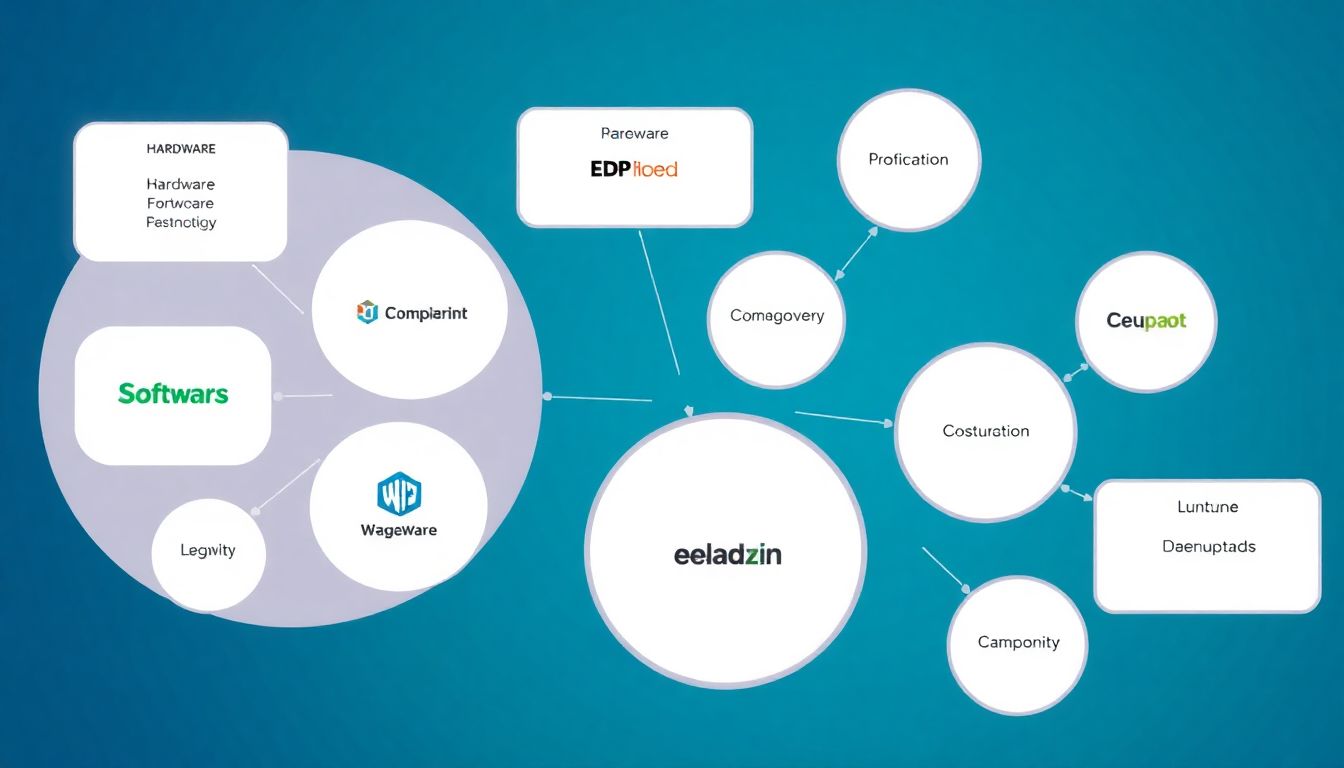

Investing in Artificial Intelligence (AI) Exchange-Traded Funds (ETFs) can be an enticing prospect given the sector’s potential for growth and innovation. However, investors should be mindful of several key factors before making a decision. Firstly, it is crucial to consider the diversification of the ETF across the AI spectrum. This means evaluating the ETF’s exposure to AI hardware, software, and legacy businesses. A well-diversified AI ETF should include companies that specialize in AI-specific hardware, such as semiconductors and processing units, as well as those that focus on developing AI software and algorithms. Additionally, inclusion of legacy businesses that are integrating AI into their traditional models can provide a layer of stability.

Moreover, assessing the ETF’s investment strategy and methodology is vital. Some ETFs may prioritize growth and allocate more towards startups and pure-play AI companies, while others might focus on established tech giants with AI divisions. Investors should look at the portfolio composition and ensure it aligns with their risk tolerance and investment goals. It is also important to consider the fund’s expense ratio and tracking error, as these can impact overall returns.

Lastly, investors must recognize the potential volatility in the AI sector. While AI holds significant promise, it is also subject to hype cycles and technological setbacks. To mitigate risk, investors should ensure that their portfolio is balanced, with allocations across various sectors and asset classes. This approach can help weather potential downturns in the AI sector. Additionally, staying informed about market trends and technological developments can enable investors to make more prudent decisions. Consider the following when evaluating an AI ETF:

- The ETF’s historical performance and how it has weathered market fluctuations

- The fund manager’s experience and track record in the AI sector

- The ETF’s liquidity and trading volume, which can impact buy/sell spreads

Roundhill Generative AI and Technology ETF

The Roundhill Generative AI and Technology ETF (GENAI) is a passively managed exchange-traded fund that seeks to track the performance of the Generative AI & Technology Index. The fund provides investors with exposure to the growing field of generative artificial intelligence (AI) and related technologies. Its portfolio composition is notably tilted towards companies that develop and implement AI infrastructure, platforms, and software. As of the most recent data, GENAI’s portfolio consists of a diverse mix of technology, semiconductor, and software companies, aiming to capture the full spectrum of the AI ecosystem.

A closer look at GENAI’s top holdings reveals a concentration in industry leaders and innovative startups that are at the forefront of AI development. Some of the top holdings include:

- NVIDIA Corporation: A leading manufacturer of graphics processing units (GPUs) that are crucial for AI computations.

- Alphabet Inc.: The parent company of Google, which is heavily invested in AI research and development through its Google Brain and DeepMind subsidiaries.

- Microsoft Corporation: Known for its Azure cloud platform, which offers a suite of AI services and tools.

- Snowflake Inc.: A cloud-based data-warehousing company that leverages AI for data analytics and management.

Performance-wise, GENAI has shown promising results in 2024, although it is essential to note that past performance is not indicative of future results. The fund’s performance can be attributed to the growing demand for AI solutions across various industries. In terms of expenses, GENAI has an expense ratio of 0.75%, which is relatively competitive compared to other thematic ETFs focusing on emerging technologies. This expense ratio covers the fund’s operating costs, including management fees and other administrative expenses. Investors should consider the fund’s expense ratio alongside its potential for growth and the risks associated with investing in a rapidly evolving technology sector.

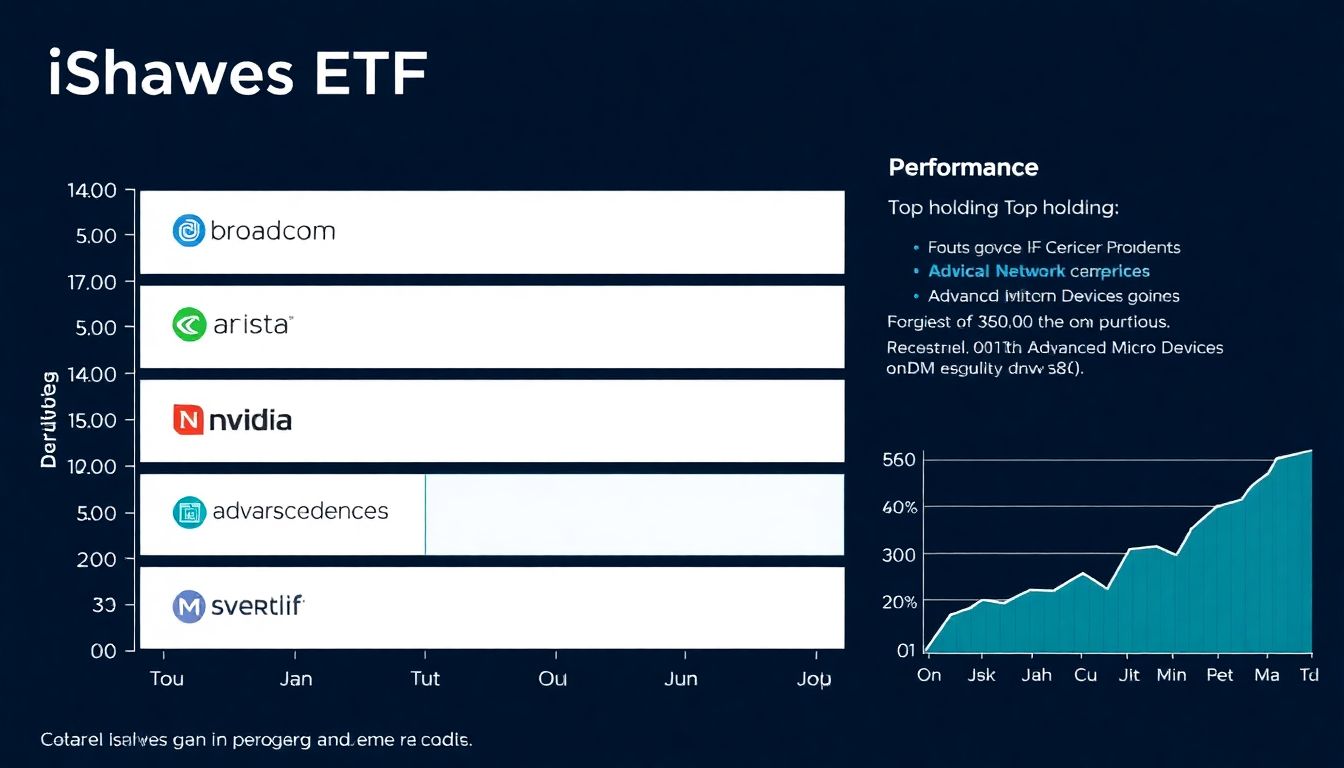

iShares Future AI and Technology ETF

The iShares Future AI and Technology ETF, often referred to by its ticker symbol IRBO, has recently undergone a significant restructuring in an effort to better align with the rapidly evolving landscape of artificial intelligence (AI) and technology. This restructuring, which was officially implemented in August 2024, aimed to enhance the fund’s focus on the full value chain of AI companies, from hardware and infrastructure providers to software developers and service providers. The restructuring involved a comprehensive review of the fund’s investment strategy, resulting in a more diversified and balanced portfolio that better reflects the current and future trends in AI and technology.

The portfolio composition of IRBO post-restructuring is notably more diverse and inclusive of various sub-sectors within the AI and technology realm. The ETF now encompasses a broader range of companies involved in AI hardware, semiconductors, cloud computing, data analytics, machine learning, and AI-driven services. This holistic approach allows the fund to capture growth opportunities across the entire AI value chain, rather than concentrating on a narrow segment. As of the latest reports, the top holdings of IRBO include:

- NVIDIA Corporation: A leader in AI hardware and semiconductors

- Alphabet Inc.: Known for its advancements in AI algorithms and services

- Microsoft Corporation: A major player in cloud computing and AI software solutions

- Amazon.com Inc.: Renowned for its AI-driven services and cloud infrastructure

- IBM Corporation: Significant contributions in AI research and enterprise solutions

Since the restructuring in August 2024, the performance of IRBO has been closely monitored by investors and analysts alike. The ETF has shown promising signs of growth, with a notable increase in its net asset value (NAV) and a steady inflow of investments. The diversified portfolio has helped mitigate risks associated with market volatility, providing a more stable investment option for those looking to capitalize on the AI and technology sectors. While it is still early to draw conclusive long-term performance metrics, the initial indicators suggest that the restructuring has positively impacted the fund’s potential for sustainable growth and resilience in the ever-changing tech landscape.

FAQ

Why should investors consider AI ETFs over individual AI stocks?

What are the key segments of the AI industry?

- AI Hardware: Companies that produce chips, sensors, and other hardware components essential for AI applications.

- AI Software: Companies that develop AI algorithms, platforms, and software solutions.

- Legacy Businesses: Traditional companies that are integrating AI into their operations to enhance efficiency and innovation.

How has the Roundhill Generative AI and Technology ETF performed in 2024?

What is the expense ratio of the iShares Future AI and Technology ETF?

What are the top holdings of the iShares Future AI and Technology ETF?

- Broadcom

- Arista Networks

- Nvidia

- Advanced Micro Devices

- Vertiv Holdings

These companies operate in the AI hardware segment and provide essential components for data center infrastructure and AI accelerators.